One year ago, the newly inaugurated US administration laid out an ambitious economic agenda known as the “3-3-3” plan, targeting 3% GDP growth, a 3% fiscal deficit, and an increase of 3 million barrels per day in domestic energy production by 2028. At the time, we assessed the feasibility of these objectives against the backdrop of an already resilient economy, tighter fiscal constraints, and a mature energy sector. As we enter 2026, it is now possible to take stock of early outcomes and assess whether the US is on track to deliver on its promises.

Overall, the picture that emerges is mixed. Growth performance has been more resilient than feared, the fiscal target has clearly fallen short, and the energy objective is evolving in a more nuanced and indirect manner than simplistic metrics suggest.

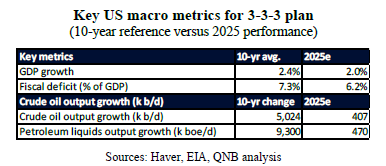

US economic growth slowed over the course of 2025, but the deceleration proved far milder than initially expected. This is particularly notable given the significant negative shock expected due to sharply higher tariffs implemented after the so-called “Liberation Day,” which weighed on sentiment but so far has proven to have a limited impact on both inflation and growth. Despite these headwinds, the economy avoided a more pronounced slowdown, with growth settling below trend but remaining comfortably positive at close to 2%.

Several factors explain this resilience. Household consumption remained supported by strong balance sheets on the back of elevated asset prices, cushioning the impact of inflation. Moreover, restrictive monetary policy eased and began to turn neutral, lowering borrowing costs and easing financial conditions into late 2025. This pivot helped stabilise investment and credit dynamics, limiting downside risks to activity. Most importantly, the foundations of a new investment cycle linked to artificial intelligence continued to strengthen. Large-scale capital expenditures by US hyperscalers in data centres, semiconductors, and digital infrastructure are increasingly translating into productivity-enhancing capital deepening. While the full macroeconomic impact of AI adoption will take time to materialise, the direction of travel is clear.

Taken together, these forces suggest that, despite the recent slowdown, the US remains broadly on track to reach the 3% growth target over the coming years.

If growth has delivered cautious optimism, fiscal policy has done the opposite. The objective of narrowing the federal deficit towards 3% of GDP has proven unattainable in the first year of the plan. Instead, deficits remain elevated, reflecting a combination of persistent spending pressures, the extension of tax breaks and political constraints on meaningful consolidation.

A central pillar of the administration’s initial strategy was the creation of the Department of Government Efficiency (DOGE), then led by Elon Musk, tasked with identifying waste, improving procurement, and streamlining federal operations. While the initiative generated headlines and some marginal savings, its impact has fallen well short of what would be required for a structural improvement in the fiscal balance. Large entitlement programmes, defence spending, and interest costs continue to dominate the budget, leaving limited room for discretionary cuts.

As a result, the federal deficit is estimated to remain close to 6.2% of GDP in 2026 and only modestly narrow to stay above 5.5% over the medium term, according to official and most independent forecasts. This outcome is broadly consistent with the idea that more aggressive fiscal consolidation would be difficult to reconcile with tax reductions and the political economy of US public spending. The additional revenues brought by higher tariffs pale in comparison to those other items. In this sense, the fiscal pillar of the 3-3-3 plan should continue to be the most challenging element of the plan.

The energy component of the 3-3-3 plan has evolved in a more subtle and complex manner. While the headline target of adding 3 million barrels per day (b/d) of crude oil production has not been met so far, US energy output has continued to expand more meaningfully through a broader mix of sources.

Capital discipline among producers, geological maturity in key basins, labour shortages, and rising costs have all capped stronger upside potential this year. However, energy production still increase meagninfully both in terms of crude oil and barrels of oil equivalent per day (boe/d), which includes total petroleum and other liquids.

At the same time, the administration’s more neutral regulatory stance toward hydrocarbons has reduced uncertainty and encouraged incremental investment, while renewable capacity has continued to expand due to favourable economics rather than subsidies alone. In effect, the US energy system is becoming larger and more diversified, even if not dramatically more crude oil-heavy. This trajectory suggests that the spirit of the energy target (greater energy availability, security, and affordability) is being partially achieved, albeit through composition effects rather than a surge in crude oil volumes. If measured in terms of overall petroleum liquids or even broader hydrocarbons, including natural gas, the target is likely going to be met.

All in all, one year into the 3-3-3 experiment, the US economy offers a scorecard in which growth is resilient and remains supported by monetary easing and the early stages of an AI-driven investment cycle. Fiscal consolidation, however, has clearly failed, constrained by structural spending dynamics and political realities. Energy outcomes sit in between, with progress emerging through diversification rather than headline oil production gains.

Download the PDF version of this weekly commentary in English or عربي